Uncleared OTC derivatives carry a disproportionate amount of risk in capital markets, leading to significant financial losses due to fraud, operational errors, and non-compliance with regulations.

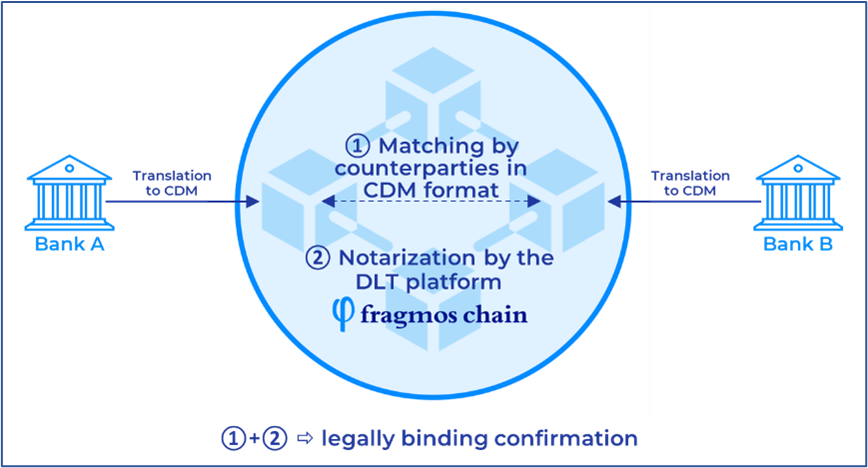

At Fragmos Chain, we have developed a platform that combines CDM (Common Domain Model) and Corda DLT (Distributed Ledger Technology) to automate post-trade processes and create a shared and legally validated description of derivatives trades, leading to a more accurate, efficient, and secure trade process.

Our platform offers a range of benefits to financial institutions, including:

- Reducing post-trade and legal costs by streamlining trade and event matching process and automating the production of digitized (paperless) legal confirmations.

- Providing legal certainty in a timely manner based on more reliable confirmations.

- Improving operational risk management by reducing fraud and mis-booking, and sharply improving compliance with regulations such as Emir and Dodd-Frank related to reporting and collateral management.

For more information, you can read Fragmos Chain’s whitepaper “Why is the management of bilateral OTC derivatives becoming simple?”